The Canadian dollar has ticked higher in the Thursday session. Currently, USD/CAD is trading at 1.2679, down 0.13% on the day. On the release front, Canada releases retail sales reports. Retail Sales and Core Retail Sales are both expected to rebound to 0.9% in September, after posting declines a month earlier. US banks are closed for the Thanksgiving holiday, and there are no US events on the schedule.

The Federal Reserve released the minutes of its most recent meeting on Wednesday. Policymakers expect the US economy to continue showing strong growth, and predicted that interest rates will be raised in the “near term”. Although policymakers did not provide further hints about the timetable of a rate hike, the markets remain convinced that additional rates are imminent. The odds of a rate hike in December are 91%, and the odds a January raise are at 89%.

The NAFTA trade agreement appears in trouble, which could bode badly for the Canadian economy. A fifth round of talks over NAFTA failed to lead to significant progress, prompting the US to send an ominous warning to Canada and Mexico. The US wants to raise the North American content of vehicles from 62.5% to 85% and require that 50% of content come from the US. As well, the US wants to put restrictions on Canadian and Mexican agriculture. Unsurprisingly, Mexico and Canada have rejected these proposals. Negotiators are hoping to wrap up a new deal by March 2018, but the US chief negotiator warned that “absent rebalancing, we will not reach a satisfactory result”.

USD/CAD Fundamentals

Thursday (November 23)

- 8:30 Canadian Core Retail Sales. Estimate 0.9%

- 8:30 Canadian Retail Sales. Estimate 0.9%

*All release times are GMT

*Key events are in bold

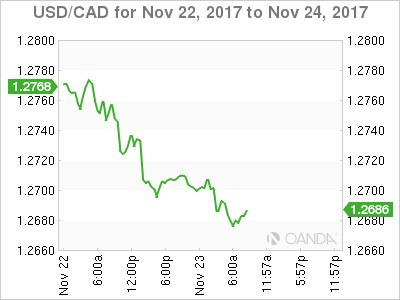

USD/CAD for Thursday, November 23, 2017

USD/CAD, November 23 at 8:05 EDT

Open: 1.2695 High: 1.2714 Low: 1.2672 Close: 1.2679

USD/CAD Technical

| S3 | S2 | S1 | R1 | R2 | R3 |

| 1.2432 | 1.2532 | 1.2630 | 1.2757 | 1.2860 | 1.3015 |

USD/CAD was flat in the Asian session and has edged lower in European trade

- 12630 is providing support

- 1.2757 is the next resistance line

- Current range: 1.2630 to 1.2757

Further levels in both directions:

- Below: 1.2630, 1.2532 and 1.2432

- Above: 1.2757, 1.2860, 1.3015 and 1.3165

OANDA’s Open Positions Ratio

USD/CAD ratio is showing little change in the Thursday session. Currently, long positions have a majority (56%), indicative of trader bias towards USD/CAD reversing directions and moving higher.